Friday, March 31, 2006

One Way to Save Money While Traveling Abroad

The little kiosks have much higher per transaction overhead costs. My advice: stick to the kiosks for only converting enough money for public transportation or some other small amount; use your credit card everywhere else. You’ll likely save money in the long run.

The wife and I are leaving for our move to Tennessee within the next 3 hrs (2060 miles to go).

Thursday, March 30, 2006

Frugal Yet Romantic Ideas for You and Your Mate

Ideas are taken from a brochure that I kept from my early college years titled “101 Ways to Eroticize Safer Sex.” The brochure was handed out by my Alma Mater’s peer health advocates group.

56 of the 101 ways to eroticize safer sex were excluded because they were either specific to the area of the University or not as tame/clean as what I’d like to post on this blog. Listed, in no particular order:

(1) Dance together in your room

(2) Go horseback riding

(3) Comb each other’s hair

(4) Play Frisbee

(5) Give flowers for no specific reason

(6) Take a hot air balloon ride

(7) Go to a music festival

(8) Hang out at a bookstore or music store

(9) Play board games

(10) Kiss each other slowly

(11) Take a sauna together

(12) Wear each other’s boxers

(13) Build sand castles

(14) Finger paint each other

(15) Take a nap together

(16) Give Eskimo or butterfly kisses

(17) Go hiking together

(18) Play wrestle

(19) Share a lollipop

(20) Give each other a foot and hand massage

(21) Listen to each other’s heart beat

(22) Watch the sun rise/sunset

(23) Leave a rose on your mate’s windshield

(24) Bring your mate breakfast in bed

(25) Drink a cappuccino at an outdoor café

(26) Read Shakespearean sonnets

(27) Go to an aquarium or zoo

(28) Take a carriage ride

(29) Play putt-putt golf

(30) Go dancing

(31) Go bowling

(32) Make bread together

(33) Cook a candle light dinner together

(34) Go kite flying

(35) Stay overnight in a bed and breakfast

(36) Rollerblade together

(37) Take a stroll in the rain

(38) Surprise your mate with a bouquet of balloons

(39) Take a walking tour of area attractions

(40) Swing on a porch

(41) Go bicycling together

(42) Leave each other love notes

(43) Swing in a hammock

(44) Sip hot chocolate w/ marshmallows by the fireplace

(45) Flirt with one another

Wednesday, March 29, 2006

Some of The Best Coupons are at the Post Office

Here's the coupons I found:

10% off at Home Depot

Free Direct TV (intro period)

15% off at JCPenney

Tuesday, March 28, 2006

My Master’s Thesis on Perceived Financial Conditions is approved!!

Thesis is specific to enlisted personnel in the U.S. Navy. People classified their financial situation as either: (1) In over head; (2) Tough to make ends meet; (3) Occasional difficulties; (4) Makes ends meet w/o much difficulty; (5) Comfortable and secure.

I separately modeled perceived financial conditions (PFCs) of single and married personnel to determine how various demographic and attitudinal characteristics affect PFC levels. Many of the results can be applied to most anybody.

I’ll start posting more stuff on this in future.

Sunday, March 26, 2006

It's a Shredding Weekend

This ignores our filing cabinet, which might also get some attention. One of the half-full bags of shredded documents:

What is Your Pension or Annuity Worth?

Many of you may want to either “juice-up” your net worth statements, or simply know what your pension is worth today, assuming your company remains solvent. Others may want to know what a fixed benefit annuity is worth.

John at ourmoneymatters blog posed the question: How do I determine the present value of my pension, if I retired today? He stated that he would collect $525/month starting today and be able to collect this amount for life. I posted an initial solution on his site that was wrong (ran numbers around 1am PST, bit tired I guess). Here’s how to figure out the value of a pension (Method #1 using simple calculator, Method #2 using a finance calculator).

I assumed a personal discount rate (rate of expected return) of 0.5% per month and a life expectancy of 30 years (360 months) past-retirement date.

1. Using a simple calculator with an exponential “^” function (minimum requirement)

(a) Determine present value of an annuity. Using the formula

PV annuity = [ 1 – (1 + R)^-n] (P/R)

R = interest rate in decimal form

P= payment

N= number of periods

Filling in numbers you get:

PV annuity = [ 1 – (1 + 0.005)^-360] (525/0.005)

PV annuity = [ 1 – 0.166] (105,000)

PV annuity = $87,570

Slight round of error, exact answer would be $87,565.60

2. Using a financial calculator like TI BAII

This is a two step five value problem.

Step 1:

a) Assuming a 6% discount rate (6%/12 months = 0.5%/month)

b) Assuming 30yr life expectancy

N= 360 months

I/Y= 0.5%/month

PV= $0

PMT= $525/month

FV= ?

Plugging into financial calculator, you get a future value of $527,370.40. Now working backwards in step 2:

N= 360 months

I/Y = 0.5%/month

PV= ?

PMT= $0/month

FV= $527,370.40

Solving for PV you get $87,565.60.

Your present value (PV) will be smaller if you expect a rate of return higher than 6% on investments. These calculations are exactly the same for annuities too.

Friday, March 24, 2006

Making Money in a Housing Bubble: S&P Launching Tradable Real Estate Indexes

Today's S&P announced the launching of 10 indexes that "will track housing prices in various regions of the

The 10 separate "city-based" indexes will track: Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York Commuter Index, San Diego, San Francisco and Washington D.C. (source: S&P)

These indexes will essentially allow people to go short or long real estate.

Here's an article that provides some additional details.

Thursday, March 23, 2006

Ebay's PayPal Goes Mobile (New Text Message Format for Utilizing PayPal)

Article 1

Article 2

By the way, I just turned in all 5 chapters of my Master's Thesis on "Perceived Financial Conditions." We'll see how the editing goes. It's 540am here in Cali and I haven't yet been asleep. I'm jacked up on chocolate covered espresso beans right now. Wonder when it'll wear off.

Wednesday, March 22, 2006

How I Got a Free Starbucks Drink Today

Venti, Mocha Frap Light w/ Whip Cream. The Whip Cream is normally not included.

The barista took my order, failed to write "whip cream" on my cup and handed the order over to the actual barista making the drinks. As you can expect, the barista making the drink didn't put the whip cream on until well after trying to give it to me (I had to ask a 2nd time).

The barista making the drink said that they'd put it on if I only asked at purchase. Well, I did ask. However, I kept my mouth shut and walked out... The barista that actually took my order noticed this and chased me down to give me a coupon for one free drink (anything).

I guess it's one of their policies to compensate you if they don't write the right thing on your cup, or otherwise mess up...

I've ordered the same drink about 100 times and they've forgotten the whip cream about 5 times. This is the first time that I got a coupon out of it. I guess, I am usually in a hurry, so much so that they would never be able to catch up with me...Or, the people taking my order previously were never paying attention.

Oh, there might be one other reason they did this. A manager was conducting job interviews outside for new baristas. Maybe, they wanted to ensure that the interviewer didn't overhear any complaints.

Perhaps they would have given me the coupon those other 5 times if I only asked. You might be able to use this info next time they mess up your order. Perhaps they'll hook you up with a free-drink coupon too.

Are You Wealthy Enough? Equation for Determining If You're as Wealthy as You Should Be

Equation (From: page 13, "The Millionaire Next Door"): "Multiply your age times your realized pretax annual household income from all sources except inheritances. Divide by ten. This, less any inherited wealth, is what your net worth should be."

I forget where they mention it, but people that exceed this are considered "prodigious accumulators of wealth." While, I believe passive income is a more powerful indicator than actual wealth, I continue to use the above equation as our running benchmark for wealth.

Use of the above equation for my wife and I yields a required net worth of $400,934.60. While we're not there yet, we'll get caught up with this variable benchmark within the next 5 years. Kind of hard since I started over after a divorce in early 2003, and the wife was also starting, financially, from a low point.

Stock Market Correction of 10% or More: Neil Cavuto Hosted Guy With 80% Accuracy Track Record

Ok, don't laugh. I'm more of a person who identifies with fundamentals. However, I was watching Neil Cavuto last night when he had a gentleman by the name of Henry Weingarten on. Neil said that this guy had an 80% accuracy track record for predicting the markets.

Mr. Weingarten runs the Astrology Fund. Couldn't find a ticker symbol for this. It seems more like it's an investing newsletter. Mr. Weingarten predicted, last night, that a stock market correction of 10% or more will occur within 90 days of March 29, 2006.

The astrologer noted a looming debt-dollar crisis. The gentleman's website is a bit hokey; however, I was able to deduce that he feels that the Nasdaq is the index that is most likely to fall.

I don't mean to be a chicken little here. I'm only trying to report an interesting/entertaining story. Here's the guy's website.

Here's some of the astrologer's commentary on the stock market.

Here's the markets that this astrologer favors.

Tuesday, March 21, 2006

6% Dividend Stock + Opinion/Use of Google Finance Worked In

Here's the two of them used for my favorite high yield dividend stock (15% tax rate) :

Google finance CTCO quote

Yahoo finance CTCO quote

Here's an S&P / Busineweek article on the company. Morningstar also ranks this company "5 Stars." If you look at its cash on the books, you'll see that it has more than double it's annual dividend in cash and is also in a positive cash flow position. Last year, I believe, it gave a special dividend of $12.

I have never bought stock in a tele-communications company. However, this one seems to have enough DSL growth to offset it's declining land-line usage, and it has enough barriers to competitor entry b/c of the unique region it serves.

I have not yet bought shares, but I am seriously considering buying shares within the next 10 days.

Plan on Retiring Early? How to Withdraw Funds From Retirement Accounts Without 10% Penalty

More details can be found here.

Also, you can find more details in a shorter article in this month's Money magazine.

Monday, March 20, 2006

My Next Stock/ETF Trade

Citigroup (C)

Vanguard Financials ETF (VFH)

IShares Germany (EWG)

IShares Canada (EWC)

IShares Australia (EWA)

Reasons:

(1) Financials since FED is nearing end of rate tightening cycle, bodes well for profit margins.

(2) Canada & Australia as trickle down plays on natural resources.

(3) Germany based on own opinion that German Labor Practicies will evolve to be more competitive with the global economy. Plus, this European country has a huge supply of human/intellectual capital that could be leveraged for remarkable benefits... Especially if they had longer work weeks!

Opinions?

Maserati GranSport Giveaway By CNBC Squawk Box

Registration: NOW OPEN

Competition starts: 4 Apr 2006

Competition ends: 26 May 2006

Winner Announced: 31 May 2006

MY DAILY SQUAWK BOX FANTASY PORTFOLIO ANSWERS (SEE COMMENTS SECTION)

1st Place: Maserati GranSport, CNBC also pays your taxes on it

2nd Place: 25 2nd place prices, prize not yet announced

How it works:

(1) Start off with $1 million in Squawk Box trading money

(2) Can add $5,000 each day to your portfolio by answering Squawk Box trivia question about that day's 830-900 EST segment.

(3) Person with highest total portfolio after stock trading and answering Squawk Box trivia questions wins car.

Registration for competition here.

Other competition details can be obtained here.

Other information about car can be obtained here.

amerivest

March 19, 2006

Author: Humberto Cruz, a columnist for Tribune Media Services

Many financial advisers who favor low-cost, broadly diversified and tax-efficient portfolios for wealthy clients are switching from no-load index mutual funds to exchange-traded funds, or at least including ETFs in the portfolios. Now, an online brokerage that caters to do-it-yourselfers is pitching exchange-traded funds to individual investors, along with advice on how to use them.

Both ETFs and index mutual funds seek to match the performance of a market benchmark, some as broad as the overall U.S. stock or bond market, while keeping costs low. One key difference is that ETFs trade like a stock on a stock exchange. You can buy or sell them at any time during the trading day at the current price and place "limit" orders to specify how much you are willing to pay or accept.

Advantages of exchange-traded funds include generally (though not always) lower annual operating expenses and fewer taxable distributions. With ETFs you have more choices to slice a portfolio by tracking narrower market sectors, such as stocks from a particular industry or country. (Narrow indexes, however, can increase risk and defeat the purpose of broad diversification.)

Arguably, the biggest drawback of ETFs is that you pay brokerage commissions every time you buy or sell. With no-load mutual funds there are no such commissions.

For investors with big portfolios ETF commissions can be more than offset by the lower operating costs and tax savings. But for small investors who want to add regularly to their accounts, such as putting in $100 or $200 every month, commissions can be a significant expense.

In addition, commissions can discourage investors from the recommended risk-reducing practice of "rebalancing," or buying or selling components of a portfolio periodically to keep its asset allocation to the intended mix.

Now, however, under a program offered by Amerivest, an online investment advisory service and subsidiary of TD Ameritrade Holding Corp., investors can buy, sell and rebalance diversified ETF portfolios with no commissions, although they must pay an annual advisory fee.

I find the Amerivest concept worthy of mention, just as I occasionally write about other financial products and services. As always, I am not recommending anything, just bringing the program to your attention.

Personally, I feel confident putting together a diversified low-cost portfolio and would not pay an ongoing fee for advice. For investors who need guidance, however, I find the Amerivest fee reasonable, considering the waiving of commissions and the broadly diversified, low-expense portfolios the service recommends. Even do-it-yourselfers can peek at the free Amerivest Web site, www.amerivest.com, and obtain ideas from the sample portfolios.

The Amerivest advisory fee is 0.35 percent of assets a year on accounts of $100,000 or more; 0.50 percent on accounts between $20,000 and $99,999, and the lesser of 2.95 percent or $100 a year on accounts under $20,000.

One-fourth of the fee is deducted each quarter.

"What we offer is a disciplined portfolio strategy geared for the long term," said Joe Moglia, chief executive of TD Ameritrade, the name of the combined brokerage from Ameritrade's acquisition of TD Waterhouse.

Although not the same as the more detailed guidance you could receive from a financial planner whom you would meet face to face, "if you are comfortable with the Internet, this is something you can do," Moglia said.

----------

Humberto Cruz is a columnist for Tribune Media Services. E-mail him at yourmoney@tribune.com.

- - -

How one program works

Under a program offered by Amerivest, investors can buy, sell and rebalance diversified ETF portfolios with no commissions. Basically, it works like this:

You go online and answer questions about your financial goals, risk tolerance, investment time frame and amount available to invest. Based on your answers, Amerivest, which is part of a registered investment advisory firm, will suggest one of more than two dozen portfolios built largely on ETFs representing a mix of asset classes designed to balance potential risk and return.

For example, one sample $50,000 "balanced" portfolio consists of 50 percent equities, including U.S. large-cap, U.S. small-cap and international stocks, including those from emerging markets; 49 percent fixed income from short-term and intermediate-term U.S. government bonds, and 1 percent cash.

You are free to accept or modify the recommendation--the service bills itself as your "financial co-pilot," meaning you remain in charge.

For example, while you'll be reminded to assess progress toward your goals, it's your job to reassess those goals and your risk tolerance periodically to make sure the portfolio remains right for you.

"The investor needs to take responsibility for himself," said Joe Moglia, chief executive of TD Ameritrade. "If his goals have changed, if his risk tolerance has changed, nobody knows that better than the individual."

Sunday, March 19, 2006

An Expensive Way to Get A Free 4 GB IPOD Nano

I don't have the spare change, but I'm considering opening a TD Waterhouse account just to buy my favorite municipal bond fund: NHMRX

You'll need to deposit $50k to qualify for the IPOD Nano. However, my favorite municipal bond fund only requires $3,000 for initial investment.

Saturday, March 18, 2006

Two Steps to Take Now to Avoid Bouncing Checks in the Future

(1) Ensure all of your personal accounts at the bank are linked. I was personally a victim of this with Navy Federal Credit Union (NFCU). A few years ago, I had my money in a NFCU money market account collecting the highest possible yield. I wrote a check for an amount well less than the funds that I had between my accounts only to find out that the accounts were not linked together. After bouncing this check, I asked if my checking account could be linked with my other account and was told NO!

My other bank does this. It routinely will tap a savings account in the event the checking account balance is insufficient. While your results may vary, I highly recommend you ask your teller or customer service representative if linking accounts is possible.

(2) Apply for a line of credit and have that line of credit attached to your checking account. I do this with all of my bank accounts now. In the event your checking account has insufficient funds, funds will be debited from your line of credit. Lines of credit typically run between 10 - 12%. You don't get charged anything if you don't use it. However, short term use in exceptional circumstances can be far cheaper than bouncing a check.

Friday, March 17, 2006

What $218K will Buy You in Suburbs of Memphis

House is 3100 sq ft, not including the 3 car garage.

Thursday, March 16, 2006

Took Profits in my Shares of New York Stock Exchange (Position Was Up 55% Since November Purchase)

I bought shares in Archipeligo in November and have enjoyed the ride ever since (especially after the AX share conversion to NYX shares). I sold because the velocity of it's share price gains is hitting a road block between $88 and $90. Plus, in the short term, there's the possibility that it'll over-pay in a bidding war for the London Stock Exchange. There's a chance that NYX will announce plans for a conversion to a fully electronic exchange. That will cause shares to rocket higher; however, while shareholders prefer this, I doubt very seriously they'll announce this within the next six months.

Selling 35% of my shares today took an amount of money off the table equivalent to my profits made to date. I'll have to marinate over the market these next few days to see where i'll put the money next. I doubt very seriously that NYX will drop below $80 anytime soon. It's a great stock; however, my position had grown much higher than all my others. Just want to do some more diversifying, and I want to try and find a different stock that will appreciate like NYX already did.

Wednesday, March 15, 2006

New FDIC limits on retirement accounts go into effect next month

Effective 1 Apr 2006, retirement accounts will be covered up to $200k. Unable to attach specific article. However it's called: "Higher FDIC limit on retirement accounts begins April 1" and is available via google news.

The article is rather long but informative.

Emigrant Direct Account Disclosure You're Required to Accept

In this section it specifically states that: "The Bank chooses to exercise its legal rights to require up to 60 days' advance written notice of any intended withdrawal from this Account and the 60 days have not passed since we received the required notice from you."

I've never seen this associated with any other checking or savings account. I went to another popular site, ING Direct, and didn't find a similar disclosure (during a quick site review).

Please post a remark here if you're familiar with this clause at any of these other online banks, or if you had problems withdrawing funds because of this clause.

I went ahead and opened an Emigrant Direct account; however, I'm a bit leery of putting more than 5% of my assets in an account that has this clause.

Tuesday, March 14, 2006

My Favorite Real Estate Magazine for Identifying Trends and Location Characteristics

I go to Borders Books about once every two weeks for reading magazines and books for free. I was disappointed this weekend when they didn't have my favorite real estate magazine in stock.

It's not a "real estate" magazine as you may be thinking. The magazine is called "Where-To-Retire." Puzzled at why a 31 year old is looking in the retirement section?

Ha, Ha, anybody that follows trends should take a moment to look at the magazine. This particular magazine caters to a huge demographic group that is entering a period where many are likely to up-root and retire to new locations fueling area specific booms. Yes, there's a housing bubble; however, if you follow the retirement dollars, look for the good deals and diversify your areas, you may do better than your friends that are only buying houses in one area.

Don't get me wrong, buying houses in only one area allows you to self manage the properties. However, if there's a serious earthquake, series of tornados or a hurricane, your real estate empire might take a larger hit than necessary.

The magazine I mentioned above will help you identify trends and area characteristics that may be favorable to you. Each magazine covers several communities with well thought out articles and discusses characteristics such as:

Median Housing Price

City/Town Profile

Arts & Cultural Activities

Recreation & Outdoor Activities

Continuing Education Opportunities

Hospital

Airports

Tax Info

Climate & Weather

At the end of the articles, key characteristics are bulleted in a quick read section. Occasionally, they will write up some communities that are only for seniors, but these types of articles are limited.

Anyways, the magazine gives you plenty of ideas so that you can judge whether or not the area is of any interest...Then, you can just go to yahoo real estate (or other site) and start surfing to find your next investment property. Ultimately, you might live there. If not, you know that many others in the baby boomer demographic are reading the same magazine and making real estate decisions based in part from the magazine or from peers that might read the magazine.

Monday, March 13, 2006

How to Pilfer the 529 College Savings Plan for Cruise Line Trip(s) Without Tax Penalty

Have you been saving laboriously in a 529 plan? What if your intended beneficiary gets a scholarship? How can you pilfer the funds without tax penalty and spend them on yourself in retirement? I'll specifically address using 529 plans for pseudo-cruise line trips after a giving you my opinion and brief subject overview.

I'm not a proponent of 529 plans, unless you've already met your retirement savings goals; however, they do serve a purpose. I hope you know that contributions can be made to 529 plans even if you don't have children. In this case, it would be presumed that you would be the one using the money to go to school. You're always suppose to be learning so this is somewhat plausible.

Non-taxable 529 Plan disbursements can be made not only for tuition but room and board expenses at the local school, even if you don't live and eat on campus. You simply have to take a course load that's 1/2 full time. In some Junior Colleges and distance learning programs 1/2 full time is as little as 4 credit hours.

Ok, now to subject of this posting, there are college programs at sea that are on cruise liners and include numerous recreational ports of call. Consider the following program if you want a legitimate way of pilfering the 529 plan and concurrently going on an extended cruise line trip:

Semester at Sea <- This program is associated with

Read this for a write up on general college at sea programs. Generally, this strategy is good only if you want to take an extended vacation (likely in retirement years) and don't mind taking a couple of classes.

Sunday, March 12, 2006

Lexus 5% / 1.5% Points Back Credit Card

I typically take our cars to the regular quick-lube or Wal-Mart for oil changes. However, I take our cars to the dealership at roughly 30k mile intervals. I just got back from our local Lexus dealership and found a visa card offer attached to the bill. The details of the offer are below.

This credit card gives 5% back on all Lexus dealership transactions and 1.5% back on purchases elsewhere. The % back is in the form of points that can be redeemed in a number of ways, principally at the dealership. Dealerships are inherently expensive for maintenance; however, if you're like me and bring it to the dealership for only major service appointments (30k, 60k, 90k, 120k, etc), then this might be a prudent option.

There is no cap on the points that accrue. There is a 50k point transaction cap on down payments made with it (equivalent to $10k down payment).

I didn't bother checking out the APR. I don't believe in using a credit card unless you can pay it off or you're using their money at 3% or less APR.

Details can be found at: Lexus Pursuits Visa

Short Term Savings Goal of $40k to Buy Real Estate

We've got a short term savings goal of $40k for a 20+% down payment. Ideally, we'd want the money by July 31st. However, we would probably be able to come up with only $30k by then. The other $10k would come from a short term loan from our ROTH IRAs, a signature loan or HELOC. Ideally, I would prefer not to do any of these. However, we're concurrently maxing out our 401Ks & IRAs and it's tough doing both. We shouldn't have to pilfer the IRA accounts or take loans if we defer the purchase past October 1st (ideally, this is preferred).

We're planning on real estate in either central

a) Condo on

b) Areas surrounding

c) Areas surrounding Bentonville (Wal-Mart country). This would require less than $40k for 20% down payment.

We'd be able to manage property in

As for

The Condo on the

Saturday, March 11, 2006

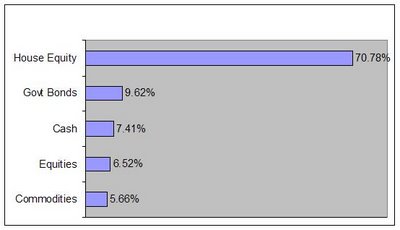

Here’s a Graphical Picture and Discussion of our Household Investments

a) BHP Billiton (BHP)

b) Rio Tinto (RTP)

c) Natural Resources Fund (UMESX)

d) Deutche Bank Commodities (DBC)

e) Pimco Commodies (PCRDX)

f) Gold (GLD)

I'm a bit heavy into commodities because I believe inflation will continue to be a problem. I view the yield curve as an indicator for inflation. In my opinion, the dip or inversion in the yield curve represents a short term decrease in our rate of inflation. However, in my opinion, this short term decrease is just that SHORT TERM.

I'm a bit heavy into commodities because I believe inflation will continue to be a problem. I view the yield curve as an indicator for inflation. In my opinion, the dip or inversion in the yield curve represents a short term decrease in our rate of inflation. However, in my opinion, this short term decrease is just that SHORT TERM.Friday, March 10, 2006

Is an Education Worth the Expense?

Do you think it will make you more competitive for promotions? Do you think that a new career field or higher education would give you enough of a marginal increase in salary to merit the time spent?

I'm a proponent of education. However, you must understand that it's important to monetize the worth of an education. You don't want to enroll in graduate programs online blindly thinking you'll get a pay raise. Here's some things to consider:

1. How much of a pay cut will you sustain over the period of pursuing an education? If you don't experience a salary decrease, do you think that your focus on an after hours education will impede your focus at work, thereby limiting promotion opportunities?

2. Once you graduate from a program, do you think you'll take a pay cut until you establish some form of seniority?

3. How long will you work in the new career field and benefit from the improved education?

The best thing to do, strictly from a monetary since, is to:

a) Monetize the net increase in salary that you expect over the remainder of your career: Present Value[ (new salary - prior salary)*(Number years remaining in work force)].

b) Monetize any impacts (decreases) to your annual salary while going to school

c) Monetize the cost of your psychic energy expended on school work. Could you have otherwise spent your psychic energy (brain power) teaching your children something useful or otherwise contribute to the household? This cost may be ignored, but you should be aware of it.

Now determine the net present value of a, b and c.

Example... If you make $90k/yr now and you pay $125k to go to med school and increase your salary to $200k/yr for a 15yr career as an M.D.

Benefit "A": ($200k - $90k) for 15 years @ 5% discount rate, Pay Raise Deferred Six Years From Now = $852,000.67

Cost "B": Lose $90/yr salary for six years @ 5% discount rate = -$456,812.29 (present value of unearned income b/c in Med School/Residency)

Cost "C": Ignored, but could be considered

Net Present Value of "A, B, C" = $852,000.67 - $456,812.29 = $395,188.38

Now determine your return on education: Return on education: [(Net Present Value A,B,C) – Education Cost]/Education Cost * 100 = ($395,188.38 - $125,000)/($125,000) * 100 = 216% return

Got a headache from all this? Don’t know how to determine Net Present Values (NPVs)? Don’t know how to use the five major keys of a financial calculator? I can try to help via email. If there’s a lot of questions, I’ll post some lessons on the blog.

It’s important to note that I simplified the discussion and calculations some for the sake of saving space.

By the way, I’m going to make some changes to this blog over the next two weeks to make the layout a bit more efficient.

Thursday, March 09, 2006

When are You Justified In Buying a New/Like-New Car?

Joseph White wrote and article published in the Feb 28th Wall Street Journal’s Personal Finance section. It's titled "Cars Last Longer, Driving a Shift In All Aspects of the Auto Sector." It states that average service lives of vehicles (based on 2001 government data) are:

a) Cars: 13 years, 152k miles

b) Light Trucks (sport utilities, vans, trucks): 14 years, 180k miles

We have two 1998 model cars. One with 112k (Lexus) and mine with 121k (Acura). I'm trying to hold off on splurging. I'll probably wait till we exceed either the 13yr or 152k mile mark, then it's reasonable for us to buy a new/like-new car. The last car we had was a 1990 Celica GTS and was sold at 144.5k miles.

Cars are really the only thing I'm materialistic about. Oh, and the Lexus was bought used. Yeah, I'm ignoring the fact that some imports typically have longer than average service lives. Please be kind if you slam me for not being frugal enough.

Opinions?

Wednesday, March 08, 2006

GO New York Stock Exchange (NYX)!!! Stock Cheerleading With a Couple Insightful Comments about NYX

I heard an interesting tidbit on NPR while coming in to school. The New York Stock Exchange could operate at 10% of its current operating cost if it converts to a fully electronic trading system. I sincerely hope none of my readers work on the floor of the stock exchange.

I will get around to detailing my stock portfolio with a nice picture, diagram or spreadsheet by Sunday night. Please remember, I said in my intro that I save aggressively and invest moderately. NYX has certainly offset the short term hit I’ve taken in my commodities position... I will likely include a discussion on the inverted yield and how it ties to some of my portfolio decisions (sounds exciting... HA, HA, sarcasm)

I'm not a rocket-scientist or anything with stock picks. I've been typically good with identifying companies with sound strategies. I have been poor with timing sales of shares. Cases in point: I was buying shares of Ameritrade in the high eights and low nines within last 22 months. I was also buying SanDisk and Garmin around this time frame. These were roughly 3 of 10 stocks I was buying... The other stocks didn't tank or anything, well, one did (EBAY)... I just cashed out about a month or so before their rallies to set up a savings account for house down payment.

Hopefully, talking though my investment decisions on here will help me better rationalize my choices. More to come later, .getting back to thesis on Perceived Financial Conditions…

My Counter Prosper.com Interest/Dividend Strategy

Right now, I'm specifically interested in buying preferred stock in companies. I ran a search this morning and found 70 companies with dividend rates above 8%. I have not yet found a companion website that does yield-to-maturity calculations though. I'm going to hold off buying any of these preferred stocks until I can blog on here an easy-to-use site for determining yields-to-maturity. If not, I’ll probably show the required calculation and give a tutorial. Of the list of 70 preferred stocks, there were a few that caught my eye. I feel that buying a few preferred stocks could diversify your investments and hedge your risks against default on any Prosper loans.

I do have one problem with Prosper right now. It appears from the reporting of other blogs that there is an excessive period where PROSPER is collecting interest on your money without sharing this interest (let me know if I’m wrong). This idea is inherently flawed in that it increases the likelihood of lenders increasing their risk tolerance and lending to higher risk candidates just to get their net preferred yield on loans.

Here’s Wikipedia’s definition of yield-to-maturity. They define YTM for only bonds; however, I believe that an equivalent calculation could be done for preferred stocks. If not exact, a close enough SWAG. R/ FJ

Is Google Adsense a Crock of _____ ?

It seems they don’t want you to screen the advertisements placed on your website. Each day over the past week I clicked on advertisements that I was unfamiliar with and blocked those that I didn’t like at Adsense’s block competitor list. Apparently it’s MY MISTAKE for trying to screen chaff that their filter lets through. They apparently classified this as fraudulent clicks.

To add insult to injury, GOOGLE doesn’t give you a 1-800 number to call to rectify the matter.

I’ll make every attempt to retrieve my list of “blocked competitor adds” and share them with you. Frankly, I was disappointed that the Adsense Algorithm allows so much crappy advertisement through. If this isn’t resolved soon, I’ll drop my favorite search engine in favor of Yahoo. Any comments/tips?

Free Money: My Opinion on 0% APR Credit Card Offers

My background: At the age of twenty-five, I had never looked at my FICO score, but I had a credit representative tell me it was the highest they had ever seen. Forty-two months later I had been married and divorced. My FICO score was now in the mid five-hundreds. Eighteen or slightly more months later the FICO score was back up to mid-7s. Now it's 771. It took a slight hit and fell from 780s surrounding my recent home purchase.

I believe first in keeping the number of inquiries on your credit report to a low number. Right now I have seven unique inquiries in the last two years. Credit lenders typically look at any series of inquiries occurring within a 15 day period as related and count them as one unique inquiry (I’m reasonably confident on the number of days, but correct me if I’m wrong).

If I get my inquiries below 7, perhaps around 5, I’ll probably get the HSBC 1% rebate MasterCard with a one year 0% APR. Once the one year promotional APR is over, I’d switch back to my 5% and 2% rebate credit cards. It's important to note that you must exercise a reasonable amount of due diligence to find a credit card that doesn't charge a 3% balance transfer fee. The HSBC MasterCard is not one of those. If you need one of those, the Discover miles card might do this for you. Anyways, I generally hate BALANCE TRANSFERS because they only prolong the inevitable (facing reality and paying it off). Only those that set up parallel high yield savings account(s), avoid hurting themselves to bad; however, their FICO score still suffers a bit.

Other credit card tidbits:

a) You're FICO score is partially determined by your "credit card available balance percentage." If you have a credit card with a zero balance and close it, both your FICO score and percentage will get worse.

b) If you close a credit card account anyways, it's best to close those accounts that have the shortest history. If you want to close an account that has been open a long time, it's generally best to close those accounts used the least (relative to your other accounts used over this longer period of time).

I extend my apologies to my subscribers. I have submitted this story several times today. However, it wasn’t picked up on one of the pfblog aggregators properly. I’m resubmitting “fresh” copies until it goes though. Hopefully, this bug (on my end or there’s) will be worked out today and not persist beyond this posting.

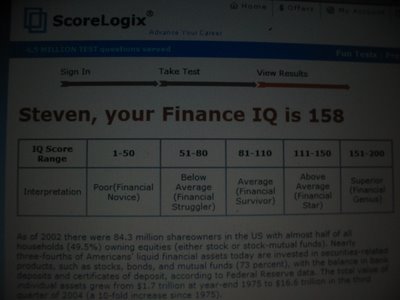

My Financial IQ Per SCORELOGIX.COM

The exam was taken unaided (without any references), only a calculator for one question. The exam is eight pages with approximately five questions per page. The picture will enlarge if you click on it. It says: "Steven Your Finance IQ is 158"

The scoring breakout is:

1-50: Poor Financial Novice

51-80: Below Average (Financial Struggler)

81-110: Average (Financial Survivor)

111-150: Above Average (Financial Star)

151-200: Superior (Financial Genius)

I'll update my score and picture if the results from my first test ever get transmitted to my hotmail account. You can access scorelogix here.

Tuesday, March 07, 2006

Non-Finance Entry: Another Way for Sports Fans to Ruin Your Productivity at Work & Home

Here's their blurb: "NCAA® March Madness™ on Demand is totally FREE for the first time ever! Get LIVE game broadcasts of CBS Sports television coverage of NCAA® March Madness™ streaming on your broadband-connected computer.

All 56 games from the first three rounds of the tournament will be available FREE.* Plus, watch highlights and recaps all the way through the championship!"

To register, go here.

This sports news post will be removed after one week to help maintain personal finance relevance.

Recommend You Read This Guy's Blog

The Rutledge Capital website has a very efficient lay-out. It reminds me of the Wall Street Journal in that it has key topics in column format for very quick read and overall website survey.

It's important to understand how he thinks. One of his key points involves Leonardo da Vinci: "When people asked Leonardo da Vinci the secret of his creative and inventing genius, he replied "Saper Vedere," to know how to see. Our objective is to help people see the link between government policy, capital formation, and growth, then help them see strategies for growing their businesses, increasing the value of their investments, and improving their economic lives."

Other descriptive comments about how he thinks are listed here.

I know the U.S. has an attitude about the Fed Chairman... When the Fed Chairman speaks, everybody listens. I listen to Dr. Rutledge as closely as most other people listen to the Fed.

Where do I find time for this??? It puzzles me too, I'm a full time student till the end of March... At the end of April I start a full time job. I'll start drafting blog entries at night then... Fingers crossed that chapters IV and V of my thesis will turn out fine (working on over these next 10 days)...

Later, FJ

Dirty Dozen IRS Tax Scams

Each year the IRS issues a list annually of the top 12 tax scams. "Victims end up losing the cash they pay to the promoters of these scams, but even worse, victims often find themselves in deeper debt to the IRS."

1. Phishing. This made it to the list since some of these scammers are posing as IRS agents. "A typical e-mail notifies a taxpayer that he or she is due a tax refund and tells them to click on a hyperlink and visit an official-looking Web site." Other variations of this include fake IRS emails notifying you that you're under audit. The IRS never uses email to contact taxpayers.

2. Form 843 tax abatement.

Taxpayers request abatement of previously assessed tax using Form 843.

The filer uses the Form 843 to list reasons for the request.

The IRS says one of the reasons commonly given is: "Failed to properly compute and/or calculate IRC Sec 83 Property Transferred in Connection with Performance of Service." 3.Zero return.

In this scam, promoters instruct taxpayers to enter all zeros on their federal income tax filings.

Filers enter zero income, report their withholding and then write "nunc pro tunc" Latin for "now for then" on the return.

They often do this with amended returns in hopes the IRS will disregard the original return which reported wages and other income. 4.Zero wages.

A taxpayer attaches to his or her return either a Form 4852 Substitute Form W-2 or a "corrected" Form 1099 that shows zero or little wages or other income.

The taxpayer may include an explanation on the Form 4852 such as "statutory language behind IRC 3401 and 3121" or may include some reference to the paying company refusing to issue a corrected Form W-2 for fear of IRS retaliation.

The Form 4852 or 1099 is usually attached to a "zero return." 5.Trust misuse.

Promoters urge taxpayers to transfer assets into trusts and promise reduction of income subject to tax, deductions for personal expenses and reduced estate or gift taxes.

These trust scams have been around for years and go by various names: Pure Trusts, Common Law Trusts, Constitutional Trusts, Freedom Trusts, Patriot Trusts and more.

The IRS reports there are currently more than 200 active investigations under way and three dozen injunctions have been obtained against promoters since 2001.

Taxpayers should seek the advice of a respected professional before entering into a trust. 6.Frivolous arguments.

Promoters have been known to make the following outlandish claims: The Sixteenth Amendment to the Constitution which gives congress power to lay and collect income taxes was never ratified; wages are not income; filing an income tax return and paying taxes are merely voluntary; and being required to file Form 1040 violates the Fifth Amendment right against self-incrimination or the Fourth Amendment right to privacy.

These arguments are false and have been thrown out of court. 7.Return preparer fraud.

Dishonest income tax return preparers attract new clients by promising large refunds.

They file incorrect returns and take part of the refund, charging exorbitant fees.

No matter who prepares your return, you, the taxpayer, are ultimately responsible for its accuracy.

Don't fall victim to these con artists. 8.Credit counseling agencies.

The IRS is in the process of revoking the tax- exempt status of numerous credit-counseling organizations that operate under the guise of educating financially distressed consumers while charging debtors large fees and providing little or no counseling.

Beware of credit-counseling organizations that claim they can fix credit ratings, push debt payment plans or impose high set-up fees or monthly service charges that may add to existing debt. 9.Abuse of charitable organizations and deductions.

The IRS has seen increased use of tax-exempt organizations to improperly shield income or assets from taxation.

An example cited by the IRS is when a taxpayer moves assets or income to a tax-exempt supporting organization or donor-advised fund but maintains control over the assets or income, thus taking a tax deduction without really transferring a benefit to charity. 10.Offshore transactions.

Putting your money and investments in offshore accounts is not illegal.

Putting your money and investments in offshore accounts and not paying taxes on them is illegal.

Despite a crackdown by the IRS, people continue to try to avoid U.S. taxes by illegally hiding income in offshore bank and brokerage accounts or using offshore credit cards, wire transfers, foreign trusts, employee leasing schemes, private annuities or life insurance.

11.Employment tax evasion.

The IRS has seen a number of illegal schemes that instruct employers not to withhold federal income tax or other employment taxes from wages paid to their employees.

Such advice is based on an incorrect interpretation of Code Section 861 and other parts of the tax law and has been refuted in court.

The IRS also has seen an increase in the area of "double-dip" parking and medical reimbursement issues.

12.No gain deduction.

Filers attempt to eliminate their entire adjusted gross income by deducting it on Schedule A.

The filer lists his or her AGI under the Schedule A section labeled "Other Miscellaneous Deductions" and attaches a statement to the return that refers to court documents and includes the words "No Gain Realized."

Saving a Mint on Moving Trucks

Moving truck rates are determined by supply and demand. If an area is a hot spot for moving to, then the rates you'll get on moving trucks leaving the area will be very good (because they want to clear out their building supply of moving trucks). Conversely, if an area is unpopular for moving to, then there will be a shortage of trucks if you want to leave. Rental companies will jack up their prices to discourage rental demand so that it falls in line with their actual supply of trucks.

You will be surprised that if you adjust the location where you pick up a moving truck by 100 or more miles you could likely find some much better deals (even after covering gas expense). Here's my extreme example of where I saved approximately $1,000.

I was moving from eastern Pennsylvania to the Gulf Coast. The cost of a 25ft moving truck and car trailer would have cost close to $2k. I have family on the Gulf Coast so I visited them first and picked up the moving truck from a lot 60 miles away from where I planned on turning the truck in ultimately. I paid $250 plus an additional $150 for three extra rental days. This brought my total to about $500. The truck was then driven up to Pennsylvania loaded and brought back down. I specifically called the corporate office to first verify that the truck had unlimited mileage (used Penske truck). Yeah, I paid for extra gas going up but I still saved close to $1000.

If that tip is to extreme/crazy, recommend the following additional tip:

Call the place renting the moving truck prior to pick up and specifically request a diesel truck. I did this 2 days prior to our move to California and got a truck that was virtually brand new and a diesel (much better mpg). If you don't do this you'll be relying on simply what they give you. What they give you could be anything. My original truck rental place couldn't find an available diesel truck (they knew they wouldn't get the rental money, so they had no incentive to find one). Instead, I called PENSKE's 1-800 number had them find me one on another lot. I switched my reservations over the phone and got a diesel truck for the 2300 mile move.

My extreme example that netted the total $1000 savings was done in 2001. Doing this today could still save you money; however, you'll have to run the numbers prior to ensure that today's gas prices aren't prohibitive to your specific situation. As an alternative, you can still look to other rental lots in an expanding search around your location, you'll could ultimately end up with a much better deal (even after additional gas expense).

...Ok, I might be setting myself up for complaints about today's gas prices... bring it on... I still stick to this strategy, I know that it could help around 50% or more of those people doing one way trips (if you put up w/ the added inconvenience).

Financial Voyeurism: My Short Term Money Strategy/Issues

1. Just reset my 401k contribution percentageup to ensure it gets maxed out by years end.

2. Making wife's 2005 IRA contribution within next 30 days.

3. Have $10,313 in checking/saving accounts now.

4. Bringing both high mileage cars (112k & 121k miles) into dealerships this week.

We've been saving over half of our take home pay each month (kinda like Sir John Templeton's savings rate early in his life). This savings rate is already starting to take a hit though with our preparations for the upcoming move (tires, auto work, etc).

Anyways, we should be eecking out roughly a 30% savings rate after the move until wife gets a new job. Once she gets established we'll maxing out her 401K and scouting for more investment property in the South East. If we can't find any good values we'll probably just plow money into our highest interest rate mortgage (5.85%) on an investment property.

Monday, March 06, 2006

Military Money: My Experiences with Military Scholarships (For Parents Or Potential High School Junior/Seniors)

This is what the military has paid towards my education: 1) $80k+ for a four-year degree, 2) Monthly subsistence allowance while in college, 3) My MBA (completing this month).

In five to six more years i'll qualify for PhD programs, but would have to apply and successfully compete for the scholarship.

Ok, some things I know that might help:

1) The $80k+ scholarship: I applied for an Air Force ROTC and Marine Corps ROTC scholarships. While I applied in '91, many of the experiences remain valid. I received a $32k offer from the Air Force and an $80k offer from the Marine Corps. I accepted the Marine Corps offer and later changed over to Navy while in College.

a) You can apply for the scholarships of all services. The recruiters will try and get you to commit to one service but you don't have to. The recruiters, at least back then, were poorly versed in officer programs. If you are a parent, you should ask for the contact information on their area (regional) officer programs officer to answer any questions that you feel the recruiters are not adequately addressing.

b) Your child would have to do a fitness test and extensive medical screening.

c) Once in College, they'll have to take about one extra military-oriented class on top of their regular curriculum each quarter/semester. They will also have to do group physical training one to three times a week depending on the school. They will also have to drill (march in formation) one to two times a week.

d) THE MILITARY WILL ALLOW YOUR SON/DAUGHTER TO BACK OUT OF THEIR SCHOLARSHIP COMMITTMENT WITH NO REQUIREMENT TO PAY IT BACK AFTER THE FIRST YEAR. If your child starts the second year of college on the military's dime, then they're pretty much committed.

e) Once they graduate, they typically owe the military 4 years of active duty for the military scholarship, then 4 years in the inactive ready reserves. Graduates may owe more if they elect to participate in any special career programs (i.e. becoming a pilot, etc)

2) Graduate School:

a) If your child is a near perfect student in college while getting their bachelor degree, then they may be eligible to go straight to graduate school on the military's dime.

b) I graduated w/ a 3.37 in Engineering, so I wasn't competitive for this. I had to serve four years on active duty before they would send me to graduate school for free. Instead, I deferred graduate school until I had been in around eight years. If the military pays for a typical two year grad degree, the graduate would likely owe around three-four years of follow on service.

c) Opportunities for Grad School include being able to go to school full time and concurrently receive your regular salary.

3) PhD:

a) The military has the permanent military professor program. If you're smart, then you can apply for this program once you've been selected for promotion to O-5 (Commander in Navy, equivalent to Lieutenant Colonel in other services). Once selected, the military will pay your tuition and expenses for a number of good schools (Harvard, Stanford on list). If you accept this scholarship you would have to agree to serve as a faculty member at one of the service academies (Annapolis, West Point, etc). I'm only familiar with the feeder to Annapolis though. You would then have to serve as a faculty member until you've reached 30 years of military service.

Besides these, everybody qualifies for approximately $250/credit hour in tuition reimbursement while on active duty. Members that take this will owe two years of service after receiving this reimbursement. If they decide to get out, they'll have to pay back a pro-rated amount of this tuition reimbursement.

Finally, the programs that I'm not talking about: GI Bill, Med School, Law School, etc are available; however, I don't have direct experience with. If you want info, I could potentionally do a referral.

Compete in the Smart Money Market Madness Competition and Get Free Issue Too

If you register, you'll pick stocks that you think will have a higher price appreciation than its in-bracket competitor(s). Participants will set up stock pick brackets, no-later than 17 March, in the following categories: Growth, Value, International and Income.

Participants that do well may win sirius satellite radio equipment and subscriptions. So yes, there is some advertising that you may see on the website... Additionally, Smart Money will probably try selling you a subscription too.

My participant name for this contest is "Finance Junkie."

Leveraging Travel Search Engines (BOTS) to Get the Cheapest Rates

Quick Summary:

1. Rental Cars: Sidestep pulled the best rates for a full size rental car in all three cases.

2. Airline Tickets: Kayak pulled the best rates for airline reservations in 2 of 3 tests, but edged out others by less than two percent. In 1 of 3 cases, farechaser significantly beat out the others by fourteen percent.

3. Farechaser did not have the option to search rental car databases.

4. Farechaser's adds flashed in an annoying manner for prolonged periods of time during page loading.

5. Kayak has an auto complete feature for entering airport locations that seems useful.

Airline Fare Test (All trips roundtrips, 3/31/2006 - 4/2/2006):

1. San Jose (SJC) to Memphis (MEM)

a.) Kayak: $342 (2% less than sidestep)

b.) Farechaser: $347

c.) Sidestep: $349

2. Los Angeles (LAX) to New York (LGA)

a.) Farechaser: $304 (14.4% cheaper than Kayak)

b.) Sidestep: $339

c.) Kayak: $355

3. Seattle (Tacoma) to Miami Int'l

a.) Kayak: $483 (0.2% cheaper than other two)

b.) Farechaser: $484

c.) Sidestep: $484

Rental Car Test (Full Size Rental, 3/31/2006 - 4/2/2006):

1. Memphis (MEM)

a.) Kayak: $78.69

b.) Farechaser: N/A

c.) Sidestep: $75.38 (4.2% cheaper)

2. New York (LGA)

a.) Farechaser: N/A

b.) Sidestep: $163 (6.9% cheaper)

c.) Kayak: $175

3. Miami Int'l

a.) Kayak: $99

b.) Farechaser: N/A

c.) Sidestep: $61 (38.4% cheaper)

I did not test Priceline or Hotwire since these sites tend to be stricter in locking you into your purchase, and their reservations are typically non-refundable or tough to change once they are made. Aggressive shoppers might get better deals on these sites but would sacrifice some flexibility.

Note: Individual results may vary

Sunday, March 05, 2006

Potential Wives’ Tale in the Making: How to Raise a Finance Savvy Child

She continued to do this until I was a three year old and could make change for dollar bills and other denominations.

While I seriously credit this as a contributing factor, you've got to take this with a grain of salt (so to speak). I have not yet heard of any other parents reporting similar experiences.

I would also caveat this with the fact that children are very impressionable at these ages. A child with adverse environmental factors and parents taking this to the extreme might end up with a child similiar to a Scrooge or "Gordon Gecko" (Gecko from movie Wall Street). Again, remember this is conjecture but nonetheless sincerely stated to provoke comments on the subject.

New FDIC Limits on Retirement Accounts in 2006

"The biggest change: Starting no later than November, depositors will get as much as $250,000 in insurance coverage for retirement accounts. The amount covered in other accounts will stay at $100,000."

"The law also would allow the coverage limits for other types of deposit accounts to increase in $10,000 increments, starting in 2010, depending on inflation."

The above comments are taken from Kathy Kristof's article in the Hartford Courant on March 3, 2006. Her article is titled: "Saving to Retire? Bank Option Gets Better - Higher FDIC Insurance Limits Could be Attractive to Retiring Boomers... "

Free Real Estate Research: A Fortune 500 Retailer Approach

Do you feel nervous about putting down your hard earned cash for buying a house or condo? Not certain if the area is a good? If you are having a hard time with a $100k - $500k purchase, imaging what Fortune 500 retailers have to go through to make the same type of decision on new multi-million dollar stores.

Yes, retailers are pressured by shareholders to grow revenues through new store openings; however, big retailers expend a lot of time and money determining new store locations.

An interesting complimentary strategy is to look at new store openings for stores like Home Depot, Lowes, Wal-Mart, etc and verify if there are any of these new stores coming to your area. If so, then these major retailers think your geographic area has plenty of room for customer growth. If you back that up to what you're interested in, then it's also got room for housing demand.

Home Depot New Store Locations

Target newly opened stores

Walmart newly opened stores

Unfortunately, Walmart and Target are only listing stores opened in Jan, Feb and March. The Home Depot link provides scheduled future openings and is a bit more useful. Get the picture?

Saturday, March 04, 2006

Free Robert Kiyosaki Advice: Saga Continues

It is important to put into perspective the STRATEGY that Robert Kiyosaki preaches in these two PBS specials. His underlying strategy involves the creation of passive streams of income and cash flow management. For this, I respect his STRATEGY. Too few Americans focus on creating passive income streams that can last at or near perpetuity. Instead, many focus on six figure incomes and the expenditure of those hard earned dollars on material objects (I prefer to live frugally).

Kiyosaki also provides invaluable insight on the fact that many traditional investment options are not insurable.

I do recognize that his underlying theme is Real Estate, Real Etate, Real Estate. I respect his ability to market himself. He has picked a good "hook" in that everybody needs a place to live. I do own three houses and believe in his strategy. However, I do not believe in applying the real estate theme to all areas of the country. I also do not believe in applying the passive income strategy to a portfolio limited to houses alone.

I actually look at the value of the underlying commodities involved in addition to land (lumber, cement, roofing materials, etc). I also look at ratios of projected annual rental income to purchase price to ensure yields fall within a range of seven to eleven percent. I also prefer to act as a contrarian. I have managed to stay out of the 50-100% real estate appreciation rate areas (California, D.C., etc.).

While my returns are closer to half of those in the hot areas, i'm not as worried these days about the housing bubble. In my opinion, the underlying commodity prices and rental income yields help set a valuation floor for my properties in the southeast.

My hat is off to those that have banked above average real estate returns from the west coast, northeast and South Florida properties.

Multi-Tasking the PF Blogging Experience

a) Ken Dychtwald: The Changing Face of Retirement. All around an interesting interview, longest of the four listed here... Probably about 20 minutes. Con: It includes about two or three short blurbs promoting the guest's book but the promotions are shorter than what you typically see on "Cramer's Mad Money."

a) Economists Predict Growth Spurt for US: Short audio clip, majority of economists on panel predict two more interest rate hikes coming.

b) Will a cooling housing market cool the economy?. Tidbit disclosed in audio clip: Net worth of avg home owner is $185k... The average net worth of a renter is $4k.

d) New Option in Retirement Savings: Roth 401Ks. Some of the comments in this are elementary but relevant in that it gives a limited perspective on the direction employers are going in the adoption of ROTH 401Ks.

Audio clips "b" through "d" are about one to five minutes long.

I enjoyed the experience and thought appropriate to share with my readers. For those alpha-bloggers like me, I'd recommend using the NPR "your money" archives to complement your already available media, especially on weekends when Bloomberg TV is recycling content and CNBC has little relevance.

General NPR "Your Money" Archives.

Free Robert Kiyosaki Advice

This morning PBS ran "Rich Dad Poor Dad." Right now they are running "Rich Dad Poor Dad Guide to Wealth." Both are 90 minute programs each. You can find the Bay Area PBS guide here.

In general, the local station will run the program(s) again early tomorrow morning and at various times over the next two weeks.

Most of you probably don't live in the bay area. Recommend checking out your local TV guide to see if PBS is airing these programs in your area. Here's some schedules for my readers in:

Atlanta, Colorado ... If you can't find Kiyosaki on your local PBS station, you can still listen to one of his recent PBS interviews or read its transcript.

Google Kiyosaki PBS search.

Enjoy!

Best Techniques to Save on Rental Cars

This technique is only good if you're confident in the period you'll use the rental car. If you end up having to extend a day or more, you'll be stuck paying the full retail rate per extra day. In these cases, it's generally best to use AARP, AAA, Government or other organizational rates that you qualify for.

I've also received free upgrades and one day off w/ these following techniques:

1. If the rental car agency doesn't advertise that their cigarette lighters are disabled, complain about it and emphasize that you need one for your business cell. I found success in this coincidentally after leaving the lot and driving back to the place to complain. I ended up getting my car upgraded and a day off my rental fee to boot.

2. Some rental agencies have you pay at a desk and then you get your keys from a separate clerk on the lot itself. There you'll typically find any underpaid worker who is typically isolated and may not communicate frequently with the rental car desk. I've simply asked before, knowing the answer, if the lot has any intermediate grade cars w/ cruise control. The clerk said no but volunteered to upgrade me on the spot at no cost to a full size model that did... Doesn't hurt to ask.

Sites: Sidestep

Priceline

General Rental Car Search

Thursday, March 02, 2006

Like Consumer Reports? Check This Out and Earn $10

For those that don't want to write reviews, you can still learn which places are prefered by others for things such as restaurants, auto repair, etc..

Perceived Financial Conditions - Part I

Sample analyzed includes personnel ranging in age between 18 and 50 yrs. Sample restricted to enlisted personnel. On average, 19.64% perceived their condition as being in one of the worst two tiers.

Perceived financial conditions are broken up between: 1) In over head, 2) Tough to make ends meet, 3) Occassional Difficulties, 4) Makes ends meet w/o much difficulty, 5) comfortable and secure

1. Salary does not necessarily matter much once household gross income grows above a range defined by $4,000 to $5,000*. I believe this is due to spending habits being more important as household salary increases.

2. Keeping your total unsecured debt below $5k would reduce your likelihood of being in worst two tiers by 20 percent.

3. Ignorence is bliss? Actually teenagers (18.8 percent less likely) just edge out people forty and over (13.9 percent less likely) as least likely to perceive their financial situation as being in one of the worst two tiers.

4. If your spouse has an Associates Degree: 28.9 percent less likelihood of being in worst two tiers. Effect of higher levels of education had diminishing returns for my sample.

5. Having $5k - $10k* in savings reduced likelihood of being in worst two tiers by 75 percent.

6. IF YOU KNOW SOMEBODY JOINING THE MILITARY: Personnel reporting that they are not satisified with their occupation received at enlistment were 51.2 percent more likely to fall in worst two categories. Personnel happy with occupation received were 20.2 percent less likely to be in worst two tiers. Lesson here, make sure the person enlisting has a mentor or some other person helping him/her understand the occupation they are taking.

* These dollar amounts are based on 1999 data, can be roughly adjusted for inflation by multiplying by 1.13.

More info to follow as thesis chapters get approved. Turned in two chapters, three more to go!

Blogging Way to Dividend Reinvestment Plan (DRIP) Portfolio

I'd only recommend DRIPs as a long term portion of a portfolio. Below is my current portfolio of DRIPS

Home Depot (HD) - 22% of DRIP portfolio

Lowes (LOW) - 3.8%

Bank of America (BAC) - 20.7%

Southern Company (SO)* - 8.5%

Aflac (AFL)* - 8.8%

Johnson and Johnson (JNJ) - 4.4%

Budweiser (BUD) - < 1%

Yahoo (YHOO) - 8%

Exxon Mobil (XOM) - 11%

3M (MMM)* - 8%

* Buying shares of company via auto-draft

Bank of America (BAC), Southern Company, Aflac, Budweiser, Exxon Mobil and 3M have no fees associated w/ automatic purchase plans and dividend reinvestment. Initial set up fees would apply though.

I stopped buying shares of BAC because the DRIP administrator would routinely book the transactions at a price above that day's highest share price. If enrolling in their plan, recommend you scrutinize your statements.

For more info, recommend going to computershare or moneypaper.

Recommend complimenting research at these sites with an accessory site like morningstar or yahoo finance.

Wednesday, March 01, 2006

Buying Real Estate: My Mortgage Lessons Learned

1. Read “106 Mortgage Secrets All Home Buyers Must Lean – But Lenders Don’t Tell” by Gary Eldred, PhD. First third of book is dedicated to people that need help with credit or qualifying for expensive housing. Remainder is chocked full of level headed comments (AS APPOSED TO THE OTHER BOOKS ABOUT BECOMING A MILLIONAIRE WITH NO MONEY DOWN). The 106 secrets are summarized in the table-of-contents for a quick initial review.

2. Bad U.S. economy news is good news for you when you’re floating your rate (inverse relationship). For example: a high unemployment rate should help you get lower mortgage interest rates. Be mindful of economic news scheduled for release the week or two prior to your intended lock date and pay attention.

3. If you’re buying below fair value, a low appraisal may keep property taxes down but it’ll also make it more difficult for you to shed Private Mortgage Insurance (PMI) later because it’ll take longer to develop an 80 percent loan to value ratio. Generally, it’s best to get a full service appraisal because you have the best chance for the appraisal to come back over your purchase price.

4. If you don’t put 20% down at closing, you generally won’t be able to shed PMI for at least the first 12 months. After 12 months, you’ll generally either have to order a full service appraisal showing that the house is now worth 20% higher than the current loan balance… or you’ll have to refinance. Make sure it’s clear what your mortgage company requires for removal of PMI.

5. Generally, you’ll find that your PMI rate will depend on your FICO score, type of loan and down payment (LTV ratio). Generally PMI monthly premiums reduce with every 5% you put down.

6. If you’re in a situation where it's not likely for you to build 20% equity quickly (to get rid of PMI), consider rates for an 80/20, 80/10/10, 95/5/5 loan (LOAN/Piggy Back Loan/Down Payment). If you can’t get a good rate for one of these loan combinations, ask your loan officer if you can pay your full PMI premium up front. This will allow you to roll the premium over to your home loan and deduct both your home loan interest and a portion of your PMI premium if you itemize taxes.

7. There is generally no difference in the rate you’ll get quoted between 10 yr and 15 yr fixed loans. A 20 yr fixed doesn’t significantly improve you quoted rate (when compared to a 30 yr fixed).

8. Closings via mail: Try and make sure the closing attorney’s office gets the package from your mortgage company no less than 5 business days prior to closing. This allows them enough time to reforward you the paperwork and still allows additional time on your end.

9. Settlement Statement:

a) If doing non-local purchase via mail: Wire fees are usually valid. Remember, closing attorneys are charged wire fees on each incoming wire transfer. It sucks that you have to pay a wire fee on your end and have to cover their expenses associated with receiving your wire and the mortgage company wire transfers.

b) Title insurance premium, refer to article wrote up below on subject

10. Closed on last house (24 Feb 06) with Pentagon Federal Credit Union. There loan officers are paid by the hour (not commission). They offer great rates and do 90 DAY LOCKS for no additional fee. They also pay a good portion of your buyer closing costs. Credit Union membership is open to everybody. I paid a $20 lifetime membership fee and did all paperwork via internet, phone and mail. Locked 15yr fixed at 5.0% (1 point, 20% down paid). Be aware, that some of the rates quoted on their site require 20% down.

I've got more tips; however, current posting is getting a bit too long. Will post more recommendations in future.